- Your organization permit, if necessary on the field

- Financial comments throughout the earlier in the day few months

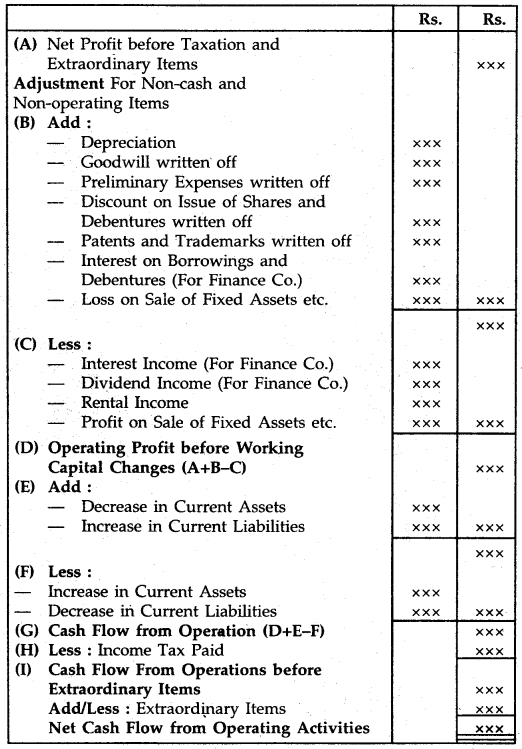

- Profit and loss statements (your own financial will help you prepare yourself this otherwise currently continue that)

- Landlord letters discussing on the-big date book repayments, like the count

- Letters out-of clients verifying the duration of the working relationships

Among advantages of are a gig staff is that you performs when you wish. You can really works simply 1 / 2 of the season or possibly you really works 1 month and you will a month away from. Hollywood stars was gig experts, also. There is absolutely no lbs salary when they’re among Tv shows. The difference?

Session here? Gig gurus should be proficient at rescuing. Become pre-approved getting home financing, you need to demonstrate that you can coverage about a beneficial year of mortgage payments. As long as the new number seem sensible, you might still qualify.

With an average month-to-month money considering net gain, in place of terrible, you ount than you might expect. To look much safer, rethink their target finances and also have more funds to place off. That’ll give you a more powerful applicant and, ultimately, provide you with lower month-to-month mortgage repayments which is easier to handle, especially if you desired coming holes in your performances.

Bonus: With a good credit history and you will sufficient funds saved, you may be considering a similar prices while the a borrower having a timeless employment. Very make it simpler with the oneself and you may you should consider a less expensive home.

Remaining month-to-month home loan repayments reasonable is an intelligent flow having gig pros who have varying incomes. To greatly help, generate a downpayment of at least 20% so you can end pricey personal financial insurance . Also known as PMI, so it insurance policy is a safety net into the financial if the mortgage default. It’s determined annually, split into 12 payments and included in your own financial monthly.

Concert professionals – just like any potential home customer – is make an effort to slashed as frequently obligations you could. So it makes a glamorous financial obligation-to-money ratio (DTI): the essential difference between your general obligations and yearly earnings – to suit your needs, net income. Lenders use DTI to decide when the you are able to pay for the monthly obligations if you are however settling almost every other expenses.

Based on NerdWallet , particular lenders want to see a good DTI ratio out-of thirty-six% otherwise faster, and more than will cap complete construction or other monthly financial obligation repayments around 43% of income. Specific might go high, however, typically having concert experts, keep debt down if you’re on the marketplace for a home.

Before you apply for home financing – long before – shoot for it to help you 700, that’s believed ideal

Concurrently, when you find yourself for the a corporate commitment or you has actually included having taxation objectives, work at settling business loans to make you an acceptable DTI.

If your money try variable, lenders will require a good credit score. You may still get home financing with less get, however, large score opened lower interest rates and higher terms and conditions, that assist keep your monthly payments manageable. Learn more about improving credit ratings here .

They bank money regarding for each and every concert to help you tide her or him over up to next

Develop, your front hustle is actually performing. You can improve your odds of providing approved by proving you to definitely organization is useful which you might be generating far more seasons more than 12 months. You could prove so it along with your a couple of years away from taxation docs, however installment loan Cleveland, to truly give a positive facts, come back some more decades than just called for.

Leave a Reply